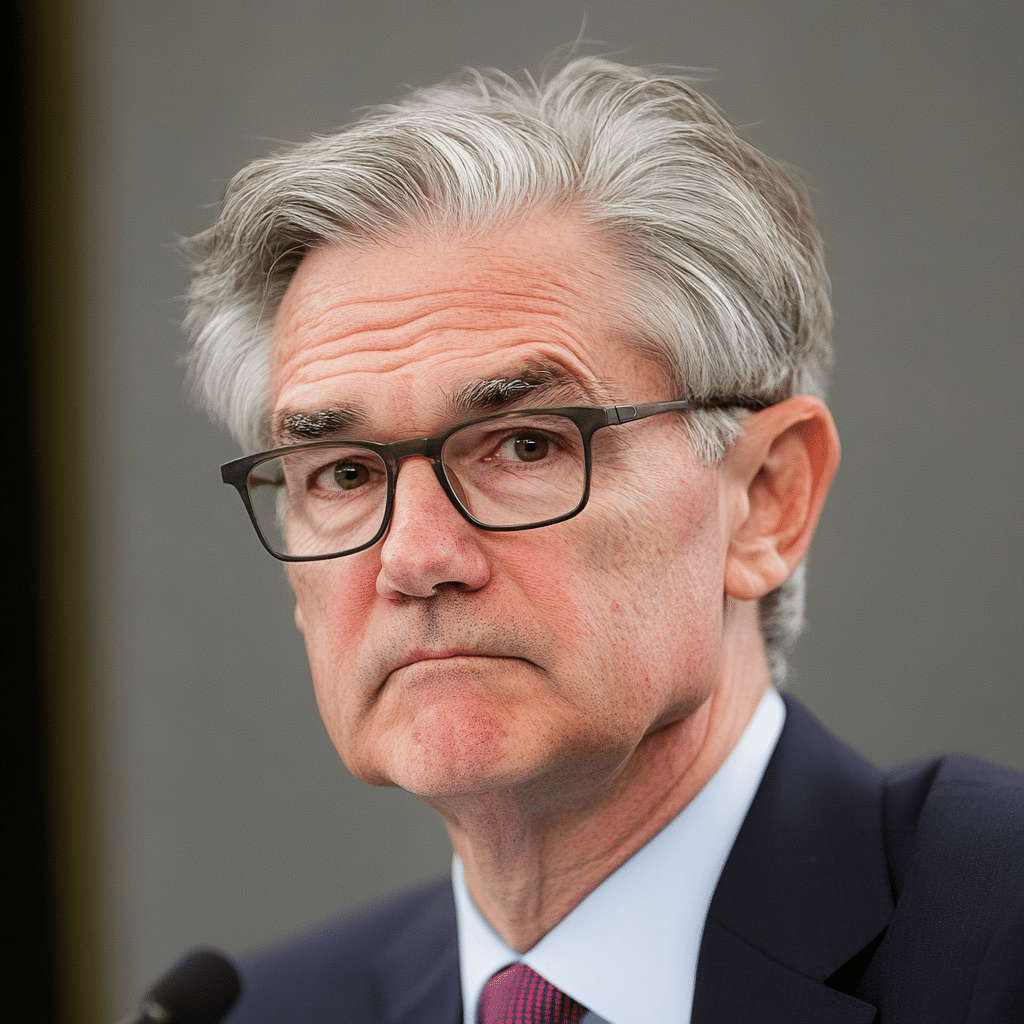

As the conversation heats up around potential fed rate cuts 2025, many people are asking how these monumental adjustments could affect their personal finances. Whether it’s through mortgages, loans, or investments, understanding the potential outcomes of lower interest rates is vital. It’s not just savvy investors who should pay attention; everyday consumers and workers across the nation will feel ripple effects in various aspects of their wallets.

1. What Are Fed Rate Cuts and Why Are They Happening?

Fed rate cuts happen when the Federal Reserve decides to lower the benchmark interest rate, directly affecting the cost of borrowing money. As fears of inflation linger, there’s growing pressure for the Fed to consider these cuts in 2025. The primary goal? To stimulate economic growth. Lower rates can make loans more accessible, benefiting everything from buying a home to facilitating business expansions.

So why are rate cuts even on the table? With economic indicators showing signs of slowing growth, the Federal Reserve finds itself at a crossroads. They may feel that a proactive approach, like cutting rates, will boost spending, which can, in turn, help maintain employment levels. If the cuts do materialize, expect mixed feelings—some celebrate the prospect of lower interest rates for loans, while others worry about future inflation.

2. How Fed Rate Cuts 2025 Could Affect Mortgages and Loans

One significant area that stands to gain from fed rate cuts 2025 is the housing market. Lower interest rates generally make mortgages less expensive. Imagine a homeowner holding a $300,000 mortgage; if the interest rate drop from 4% to 3%, that can result in monthly payments dropping significantly. This kind of savings can rack up to thousands over the loan’s lifespan, freeing up money for other pursuits like investments or spending in local shops.

For first-time homebuyers, now could be an opportune time to enter a market that’s been historically tough to crack. Lower financing costs can translate into more affordable monthly payments, allowing households to step into homeownership that might have felt out of reach before.

Moreover, those interested in refinancing their existing mortgages should keep a close eye on fed rate cuts 2025. Making the switch to a lower rate could afford homeowners the chance to reduce their payments or even tap into home equity to fund renovations or other financial goals.

3. Investment Strategies During Fed Rate Cuts

With interest rates on the decline, traditional savings accounts will yield even less. This often pushes individuals to pursue alternative investment options. Low rates typically make stocks, real estate, and bonds more appealing, resulting in a move within portfolios. For instance, tech stocks like Apple and Amazon could experience a surge as consumers feel more confident to spend and borrow.

Also, consider this: when rates dip, consumers often flock to credit markets to finance purchases. This uptick can send share prices soaring in companies that are set to benefit from increased consumer spending. Savvy investors may pivot away from stagnant options, searching for better yielding opportunities that go beyond the usual savings accounts.

Diversifying Your Portfolio

Investors looking to get ahead should focus on diversifying their portfolios. Think about exploring options like Exchange-Traded Funds (ETFs) or mutual funds that can provide a safety net against inflation concerns. Those individuals eyeing upcoming fed rate cuts 2025 should adapt early—changing risk tolerance levels can help protect assets as market dynamics shift.

4. The California Minimum Wage 2025: A Contributing Factor

As we assess the broader economic implications of potential fed rate cuts 2025, we must also consider state-specific factors like California’s minimum wage, which is set to climb to $15.50 per hour. This raise could influence spending habits, particularly among low-wage workers who could find themselves with additional disposable income.

Local businesses, especially in the retail and service sectors, may need to reassess pricing strategies to accommodate these wage increases. Places like McDonald’s and Starbucks could feel the impact directly as they navigate adjustments to employee compensation. If these businesses adapt effectively, they may boost overall consumer spending in their communities.

Ultimately, the interplay between these minimum wage increases and potential rate cuts could create a higher demand for goods and services, heating up the local economy. However, it could also pressure small business owners, who may struggle to keep up with rising costs while maintaining profitable margins.

5. Long-term Economic Effects and Inflation Considerations

While immediate consumer spending might enjoy a boost from lower interest rates, economists caution against overly optimistic projections. If the Federal Reserve isn’t careful, fed rate cuts 2025 could eventually ignite inflationary pressures. This situation poses particular risks in fast-growing states like California, where soaring prices can eat away at the increased purchasing power meant to uplift minimum wage workers.

For instance, rising commodity prices can signal inflation’s arrival, and when consumers have to spend more for essential items, the very wage increases intended to empower may fall short, delivering a double whammy. It’s wise to keep an eye on both commodity prices and consumer sentiment as indicators of how persistent rate cuts might ultimately shake out.

6. Personal Finance Adjustments in Anticipation of Rate Cuts

If you find yourself looking ahead towards fed rate cuts 2025, consider rethinking your financial strategies. Now might be a great time to ramp up debt repayments before rates fall. By employing tactics such as debt snowball or avalanche methods, you can significantly benefit from the changing interest landscape.

Moreover, think about reallocating some investment funds into areas poised for growth as the economy adjusts. With inflation a looming risk, exploring options like real estate investment trusts (REITs) or dividend stocks can offer solid returns.

Investing now in diversified channels will bolster your financial standing, keeping you on track for stability longer-term. As the saying goes, “a stitch in time saves nine”—taking proactive steps today may lead to smoother sailing later.

7. Career Impacts and Job Market Shifts Linked to Fed Policy

Higher disposable incomes from a rising minimum wage in California may vastly impact the job market, particularly sectors like retail and hospitality. These areas are poised for a potential boom as increased consumer spending flows through. Areas like Los Angeles or San Francisco could see a resurgence in hiring, with businesses eager to capitalize on growing demand.

Conversely, sectors linked to personal finance, such as lending and investment services, may also ramp up hiring. Companies may seek qualified personnel to manage the inflows of new loans and investments resulting from a more favorable economic climate.

Expect shifting dynamics in the workforce, especially in technology where start-ups might aggressively pursue talent. As interest rates decrease, companies can take on more risk and potentially invest heavily in innovation, contributing to long-term job creation as they leverage the favorable borrowing environment.

In conclusion, as we anticipate the potential fed rate cuts 2025, consumers face a significant opportunity to rethink their financial planning. Keeping an eye on immediate advantages while being wary of long-term implications can lead to wiser financial decisions. By staying informed and adjusting strategies in light of new economic realities, individuals can position themselves for success in the coming years.

Fed Rate Cuts 2025: What Could It Mean for You

When talking about fed rate cuts 2025, many folks are curious about how these shifts might ripple through their lives. A cut in the federal funds rate often brings lower borrowing costs, making it easier for consumers to take out loans for everything from cars to homes. Now, imagine a couple looking to buy their first home; a drop in interest rates could mean the difference between affording that cozy corner house or being stuck looking at studio apartments. It’s all about the little things, right?

The Wider Financial Picture

But what does the average Joe need to know? Well, fewer rate cuts can mean increased consumer spending. This often translates into more jobs and, potentially, a boost in wages. Ever thought about how sports events like the chiefs vs raiders game can be influenced by economic changes? More disposable income could lead to packed stadiums and a vibrant local economy buzzing with activity.

Fun Economic Trivia

As we play the waiting game for any signs of fed rate cuts 2025, let’s sprinkle in some fun facts! For instance, did you know that California boasts a whopping number of electoral votes? That’s a serious head-turner in any election! Speaking of head-turners, did you catch the buzz around celebrities like Emma Watson? Her net worth is as stirring as the stock market after a rate cut announcement! These colorful snippets show how interconnected our lives are with the financial landscape we navigate each day.

What to Watch For

So, how do you prepare for possible fed rate cuts? Stay in the loop about economic indicators and trends, just like fans do with where to watch gypsy rose life after lockup! It’s important to think ahead, keeping an eye on the news, especially if events like the west bengal train accident remind us of how swiftly circumstances can change. Who knows, maybe even the right investment could land you a star-studded opportunity — think of the ascension of people like Pedro Pascal, who’s been turning heads lately, not just for his career but also for personal matters.

Keeping these trends in mind can help you make informed decisions. The next few years promise to be full of surprises, and understanding how fed rate cuts 2025 might shake things up can put you ahead of the game!