As the chair of the Federal Reserve of the United States steers the nation’s monetary policy, the impact of its decisions is felt in every corner of the economy. From the price of groceries to student finances, the role carries immense weight. In this article, we delve into seven key insights about the chair’s leadership and vision within the realm of economic governance, shedding light on how these insights shape the financial landscape of the nation.

7 Key Insights on the Role of the Chair of the Federal Reserve of the United States News

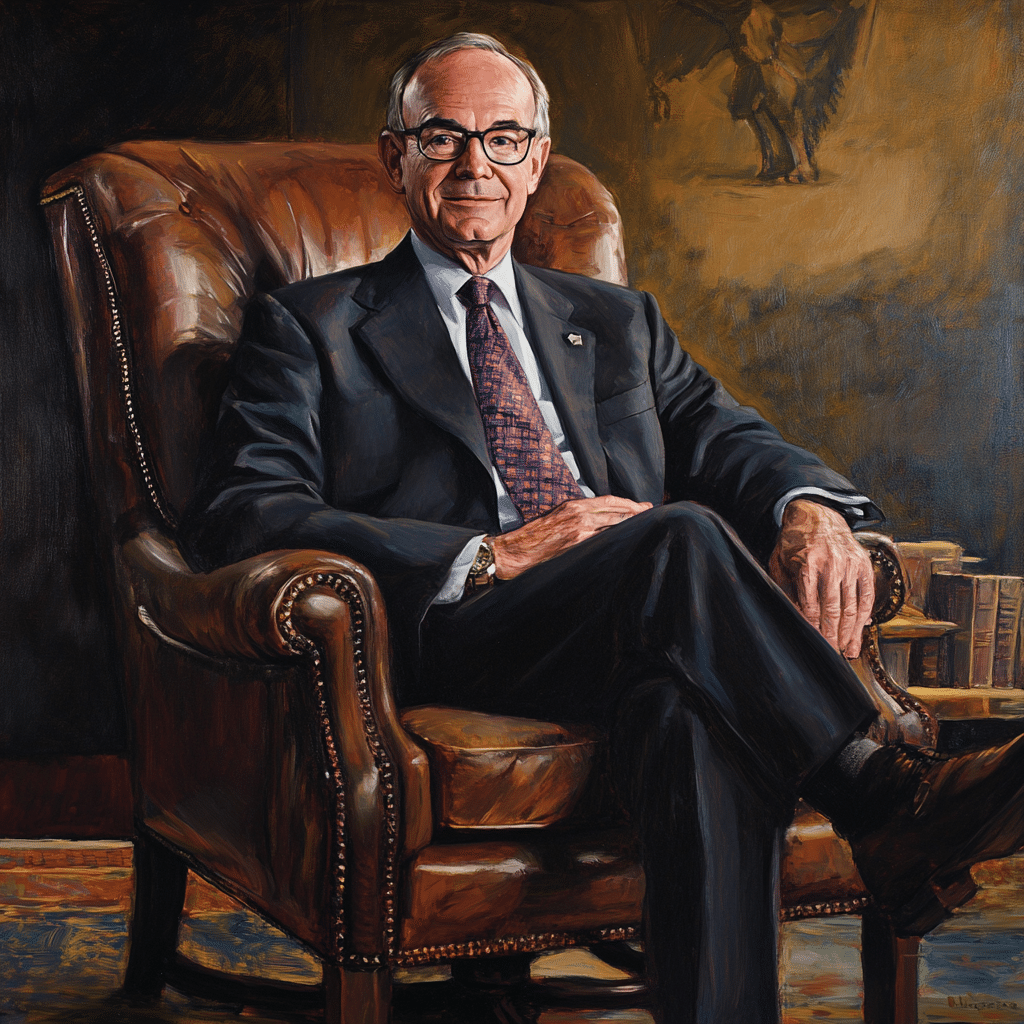

Leadership style plays a critical role in how monetary policy evolves. Jerome Powell, the current chair, has embraced a consensus-based approach, allowing for a variety of perspectives in decision-making. This contrasts with previous chair Janet Yellen, who focused heavily on data-driven choices. Powell’s style encourages collaboration and adaptability, influencing how the Federal Reserve responds to pressing economic shifts, particularly during challenging periods.

Inflation is a persistent concern for the chair of the Federal Reserve, influencing daily life, from purchasing groceries to housing costs. The Fed’s current strategy aims to juggle raising interest rates while fostering economic growth. According to a 2024 analysis, unchecked inflation could push interest rates to heights unseen since the 2008 financial crisis. This balancing act is crucial as the economy emerges from recovery phases, ensuring stability while addressing rising consumer prices.

The chair’s influence stretches beyond monetary policy into pivotal social issues like student financial aid in the United States news. In early 2024, statements from Powell suggested a strong focus on how interest rate adjustments affect student loan rates. This attention could reshape access to education for millions, especially with the ongoing discussions about Federal Direct Loan rates. By intertwining economic policy and education financing, the chair seeks to create a more equitable future for students nationwide.

Taxation in the United States news is another area where the chair has made significant contributions. With discussions around raising capital gains tax rates, key policymakers look to address income disparities across the nation. The chair’s advocacy for a more equitable tax system reflects an understanding of how taxation affects economic mobility and a commitment to reducing wealth inequality. As these discussions unfold, the connection between tax policies and monetary goals will be essential for economic forecasting.

The chair must also contend with an unstable global economy that affects domestic policy. Recent geopolitical tensions, such as those impacting oil prices and supply chains, require careful consideration in Federal Reserve decisions. Economists internationally note that the chair’s adaptability is critical for maintaining economic stability. Such external pressures underscore the importance of a nuanced approach to policy that considers both domestic challenges and global dynamics.

As fintech and digital currencies gain traction, the chair is reevaluating traditional banking frameworks. 2024 has already seen statements from Powell about exploring a potential digital dollar, which could revolutionize banking. The shift toward modernization reflects an acknowledgment of how technology is reshaping the financial sector and the Federal Reserve’s role within it. By adapting policies to incorporate technological advancements, the chair positions the Fed to thrive amid digital transformation.

Recent initiatives by the chair emphasize improving community engagement and economic literacy. Workshops and outreach programs aim to make economic concepts more accessible to the public, fostering a better-informed citizenry. This effort not only strengthens trust but also empowers individuals to make informed financial choices. By bridging the gap between policy and public understanding, the chair honors a commitment to transparency that enhances the effectiveness of monetary policy.

The Chair’s Role in Balancing Economic Initiatives with Public Expectations

The chair of the Federal Reserve stands at a crossroads, harmonizing economic policy with the public’s needs. Managing fluctuating economic conditions while addressing consumer concerns about inflation and job security is paramount. As the chair navigates this landscape, they rely on insights from various economic indicators and behavioral trends to refine strategies.

Communication is vital. By transparently discussing interest rate decisions, such as pledges to adjust rates based on inflation data, the chair builds public trust. Maintaining an open dialogue ensures that the Federal Reserve remains a credible entity that can guide economic recovery effectively. This balance between sound economic policies and public reassurance is crucial in today’s uncertain climate.

Looking Ahead: Evolving Economic Leadership

As we delve further into 2024, challenges loom large for the chair of the Federal Reserve. The rise of technology in banking, reforms in student financial aid, and shifts in taxation pose questions requiring innovative solutions. The chair will need a deep understanding of economics and societal demands to navigate these complexities successfully.

Analyzing these evolving dynamics reveals that the chair’s responsibilities reach beyond monetary policy. The ability to inspire trust and adapt to rapid changes will be vital in shaping a resilient economic future for the United States. As the economic landscape continues to shift, the chair’s role remains crucial in leading the nation toward stability and equitable growth.

In conclusion, the chair of the Federal Reserve of the United States stands as a figure of influence in addressing the intricate connections between policy and everyday life. Each decision made reflects the dual imperative of fostering economic growth while ensuring that the benefits of such growth are shared equitably across society. As monetary and economic environments continue to evolve, the chair’s leadership will be pivotal in guiding the economy through uncertain times. For those interested in the interplay of policies and personal finance, keeping an eye on the chair’s initiatives is certainly worthwhile.

Chair of the Federal Reserve of the United States News: Insights and Trivia

The Role of Economic Leadership

Did you know that the Chair of the Federal Reserve plays a critical role in shaping the nation’s economic future? Their decisions can ripple through the economy, impacting everything from inflation rates to employment levels. In fact, many have compared their clout to that of a President, like the Presidente de Los Estados Unidos, who can steer national policy. When Jerome Powell took office in 2018, he stepped into a position rich with legacy, facing challenges comparable to navigating the high seas with a Us Navy ship South china Sea as his crew.

With all that influence, you’d think these chairs would be high-profile celebs, right? Surprisingly, the general public often doesn’t know them from a hill of beans! It’s a bit like how fans adore Will Sasso Movies And TV Shows, yet many may not recognize him off-screen. Economic leadership surely holds a unique spotlight, but it doesn’t always make celebrities of its occupants!

Economic Insights and Fun Facts

The Fed’s policies can be as consequential as the innovative rollout of the Tesla Semi, reshaping industries and consumer behavior. For instance, when the Fed lowers interest rates, buying a home becomes more affordable, echoing through various sectors and even affecting businesses, like Southern Glazers wine, as they navigate financing. This interconnectedness demonstrates the subtle ways in which financial decisions touch everyday lives.

Have you ever pondered the lyrics of “What Was I Made For?” from the trending artist Billie Eilish? Similarly, those leading the Federal Reserve may contemplate their profound purpose every day. Their mission goes beyond cards and numbers; it’s about stabilizing the economy and fostering growth for future generations. With economic storms brewing, much like the Nashville severe weather that can disrupt even the calmest skies, the Fed’s leadership proves essential in forecasting and managing financial fluctuations.

So the next time you hear chair of the federal reserve of the united states news, remember that these decisions ripple far and wide, influencing more than just financial markets—they touch every corner of our lives!