In 2024, Sunderland council tax rates are once again a hot topic, especially when looking at how they compare to the lowest rates found in London. This article takes a closer look at the complexities of Sunderland’s council tax, revealing how it stacks up against some of the most affordable areas in the capital. With financial pressures mounting, it’s essential to understand what these rates mean for everyday people.

1. Sunderland Council Tax Rates: A Breakdown

As of 2024, Sunderland council tax rates present a mixed picture. The average Band D rate set by Sunderland City Council stands at approximately £1,570 per year, marking a modest increase of 3.5% from the previous year. This uptick reflects the ongoing financial struggles faced by local authorities across the UK.

When comparing this figure to some areas in London, the disparity becomes evident. Take Barking and Dagenham, for instance: their Band D council tax comes in at about £1,370, making it one of the most affordable choices in the capital. Residents there enjoy significantly lower bills compared to those in Sunderland, raising questions about the underlying reasons for such differences.

1.1. The Implications of Higher Rates in Sunderland

Higher Sunderland council tax rates can lead to increased financial stress for many families. With the average household income in Sunderland falling below the national average, many residents may find themselves struggling if council tax continues to rise. Those on fixed or lower incomes suffer the most, as every pound counts in managing their household budget.

Moreover, the rise in council tax can lead to greater challenges for the local economy. This situation might force residents to make difficult choices, such as cutting back on essential needs or delaying necessary expenditures.

1.2. The Factors Behind Sunderland’s Council Tax Rates

Several factors contribute to Sunderland’s council tax rates. Key among them are funding cuts from the central government, escalating infrastructure costs, and a growing demand for local services. In splendid places like Sunderland, local authorities often have to increase council tax to maintain vital services such as public health, education, and social care.

Further complicating the picture, economic disparities between different regions mean that areas like Sunderland are at a disadvantage. As councils struggle to juggle budgets, they may rely on excessive council tax hikes, which only add to the burden residents face.

2. Understanding London’s Lowest Council Tax Rates

To grasp the full picture, we must also examine London’s lowest council tax rates. Among the most affordable areas in London, Wandsworth stands out with a frozen council tax bill of just £961.14. This remarkable feat reflects their commitment to fiscal responsibility while still managing to provide necessary services.

Following closely behind are Westminster and Hammersmith and Fulham, with Band D rates of £973.16 and £1,386.77, respectively. These boroughs demonstrate that it is possible to maintain low tax rates without compromising essential services, a challenge that more councils across the UK often face.

2.1. How Wandsworth Achieves Lower Rates

Wandsworth’s success in maintaining lower council tax rates can be primarily attributed to a stable local economy and a well-established tax base. By effectively managing resources and minimizing waste, Wandsworth has managed to balance budget constraints while addressing community needs.

Moreover, Wandsworth’s focus on engaging with residents allows for a clearer understanding of what services are truly necessary, leading to a more efficient allocation of resources. Such innovative approaches can serve as a beacon for councils like Sunderland as they strive to navigate fiscal challenges.

3. Comparing Council Tax Increases: 2023 vs. 2024

3.1. Sunderland’s Annual Increases Versus London Trends

Sunderland’s council tax has increased by 3.5% this year, which is higher than some councils in London. For instance, Camden implemented a modest 1.99% rise. Such variations highlight the different strategies and priority levels city councils adopt to balance their budgets.

You might wonder about the impact of these differences. While Sunderland’s residents bear a heavier tax burden, areas like Camden can manage to keep increases to a minimum, thanks to broader city budgets and varied income levels within the community.

3.2. The Rationale for Council Tax Increases

Sunderland’s increase is often blamed on a range of factors, including the demands of an aging population and rising care costs. But this begs the question—how much pressure can the local population realistically manage? With average incomes running low in Sunderland, any increase in the Sunderland council tax may feel like a punch to the gut for residents.

Conversely, in areas of London where incomes tend to be higher, such as Hammersmith and Fulham, raising taxes isn’t met with intense opposition. Their residents often find that elevated council taxes contribute to enhanced services, making the higher bills more palatable.

4. Future Outlook for Sunderland Council Tax

Looking ahead to 2025 and beyond, the sustainability of Sunderland council tax rates will be a pivotal concern. With inflation predicted to rise, coupled with possible government funding cuts, it’s likely that residents could face additional increases.

Conversely, London’s boroughs like Wandsworth may offer some lessons for Sunderland. By focusing on diversified revenue streams and fostering community engagement, Sunderland could improve its financial management practices, thereby easing the burden on its residents.

5. Community Responses to Council Tax Challenges

As pressure mounts on Sunderland’s council tax, community responses have blossomed. Residents have banded together to advocate for fair council funding, demanding more transparency and engagement in budgetary discussions.

Forums for public discussions and activism around council tax fairness have gained traction. Some London boroughs, like Lambeth, have adopted similar strategies, which have resulted in more fruitful relations between local government and residents.

Wrap-Up

The ongoing examination of Sunderland council tax rates against London’s lowest underscores profound economic implications for residents in both communities. The stark differences in tax rates showcase not only the financial climates of these regions but also the variations in strategies employed by municipal governments.

As Sunderland grapples with future challenges, it would do well to take note of successful strategies from London’s boroughs, aiming to strike a balance between ensuring quality services and maintaining manageable tax rates. This way, residents can be supported while local authorities navigate the often-turbulent waters of fiscal responsibility.

Sunderland Council Tax Rates: A Comparison with London’s Lowest

Eye-Opening Trivia About Sunderland Council Tax

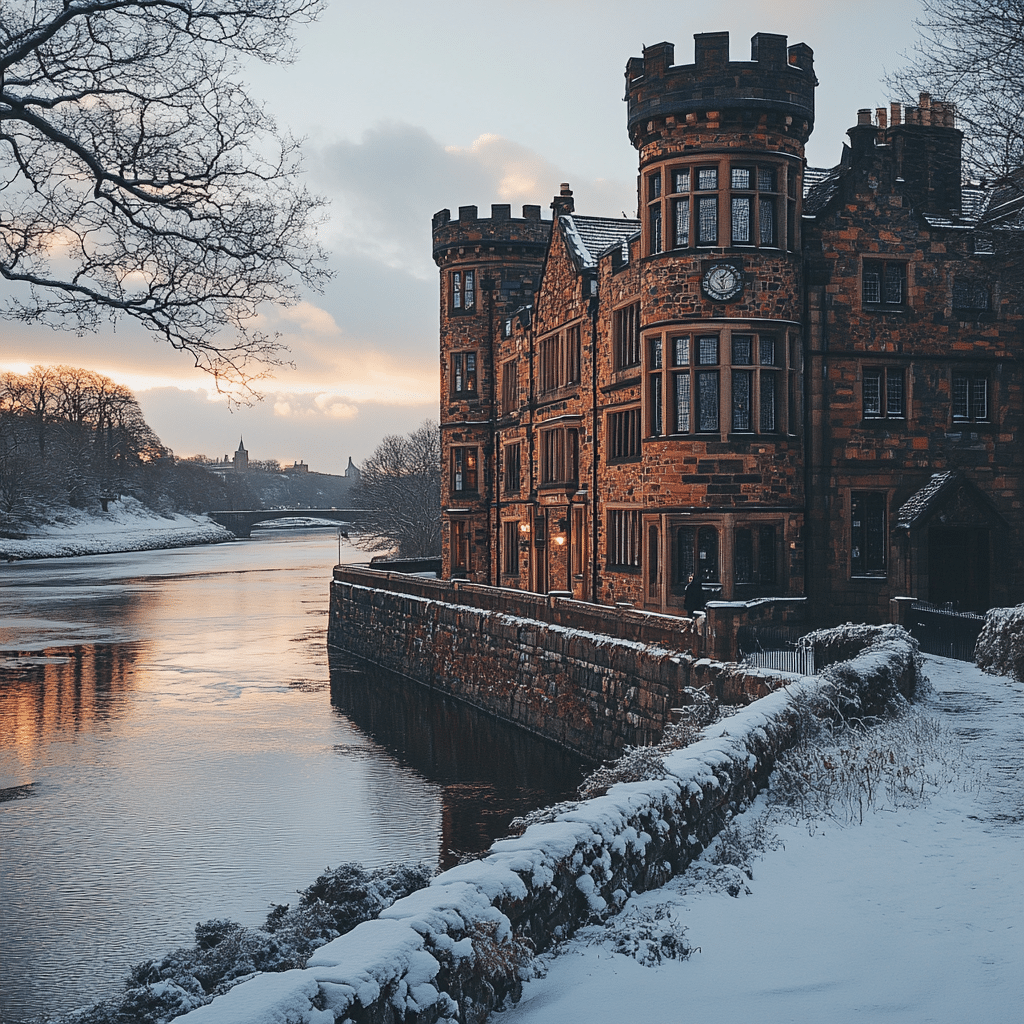

Did you know that Sunderland council tax rates are some of the lowest in England? This comes as a shocker considering the beautiful parks and amenities the city offers, which are crucial for a vibrant community life. Speaking of parks, if you’ve ever visited Sutton Bonington, you’ll know it’s an area filled with greenery and charm, much like Sunderland. Although Sunderland might not have the star power of big cities like London, its low tax could be a hidden gem for new residents or prospective homebuyers.

Another fun fact is that the council tax in Sunderland can differ significantly from what you’ll find in more affluent areas. For instance, areas like London can have council tax rates that boggle the mind—take a glimpse at how bearcat Vehicles are used by the London police forces. These types of expenses are often funded by the hefty taxes residents pay. However, in Sunderland, your dollar goes further, allowing for investment in community initiatives and facilities instead of overwhelming taxation.

The Unique Features of Sunderland Council Tax

Sunderland residents benefit from a diverse range of council services without being overly burdened by high tax rates. This is reminiscent of the health For life white marsh program, which emphasizes community wellness without the strain of excessive costs. The willingness of Sunderland Council to engage with its residents helps foster a strong bond and builds trust, ensuring services meet locals’ needs effectively.

Curiously enough, the cost savings on council tax can sometimes feel like the phenomenon described in the song She Blinded Me With Science, where surprises are around every corner. Just as unexpected discoveries can abound in science, residents often find that lower council tax allows for unexpected opportunities—like saving up for a trip or investing in local businesses. Given all these details, it’s clear that Sunderland offers a compelling option for anyone looking to settle down, providing not just affordable living but also a rich community experience.

How much is council tax in Sunderland?

In Sunderland, the council tax for a Band D property is currently set at £1,517.39 for the 2023/2024 financial year.

How do I contact Sunderland council tax?

You can contact Sunderland City Council regarding council tax through their official website, where you’ll find contact details, including phone numbers and email addresses for various departments.

What borough has the cheapest council tax?

Wandsworth has the cheapest council tax in London, with a standard Band D bill of £961.14 for the current year.

Which council is Sunderland in?

Sunderland is governed by Sunderland City Council, which is responsible for providing local services and managing council tax.

What’s the most expensive council tax?

The most expensive council tax in London is in the Royal Borough of Kensington and Chelsea, where the Band D bill is significantly higher than other boroughs.

What is the average council tax in the UK?

The average council tax in the UK varies by region, but for the 2023/2024 financial year, it’s around £1,828 for a Band D property.

What is the 65 payment for Sunderland Council?

The £65 payment for Sunderland Council usually refers to a discount or adjustment for certain qualifying residents, such as those on specific benefits, so it’s best to check with the council for exact details.

What is the bank account for Sunderland council tax?

For paying council tax in Sunderland, the bank account details you’ll need can be found on the Sunderland City Council website, specifically in the payment section.

What is local council tax support?

Local council tax support is a means-tested benefit that helps low-income households pay their council tax, depending on their financial situation.

Which borough is the most expensive?

The Royal Borough of Kensington and Chelsea is the most expensive borough for council tax in London.

What cities in the UK have the lowest taxes?

Cities like Wandsworth and Westminster in London are known for having some of the lowest council tax rates in the UK, but generally, many areas in the North tend to have lower taxes compared to southern cities.

Why is council tax so cheap in London?

Council tax rates can be cheaper in London due to various factors like local government funding and the decision by some boroughs, like Wandsworth, to freeze tax rates for several years.

Is Sunderland a good place to live?

Sunderland is considered a good place to live by many, offering affordable housing, good schools, and various amenities, but like any place, it depends on what you’re looking for.

What is the black population in Sunderland?

The black population in Sunderland is relatively small, making up around 2.5% of the total population, but community diversity is gradually increasing.

Is Sunderland a smart city?

Sunderland is working towards becoming a smart city by implementing technology to improve public services and enhance daily life for its residents.

Is Sunderland council tax going up?

As of 2024, Sunderland Council tax is not going up, as the council has frozen their rates this year.

How is local council tax calculated?

Local council tax is calculated based on your property’s value band and the local council’s budget, taking into account any discounts or exemptions you may qualify for.

What band is the highest for council tax?

Band H is the highest band for council tax, which is generally for larger properties with a higher value.

How much is council tax in South Tyneside?

In South Tyneside, Band D council tax for the 2023/2024 financial year stands at £1,610.00.